US Trade Deficit: Concern Over Projected $950 Billion Increase?

The US trade deficit, projected to reach $950 billion, sparks concerns about its impact on economic growth, job creation, and international competitiveness.

The US trade deficit, Is the Projected Increase to $950 Billion a Cause for Concern? is a recurring topic in economic discussions, often triggering debates about its implications for the nation’s economic health and global standing. With projections indicating a potential surge to $950 billion, it’s essential to unpack what this number signifies.

Understanding the US Trade Deficit

The US trade deficit represents the difference between the value of goods and services the United States imports and the value of goods and services it exports. A deficit occurs when imports exceed exports, indicating that the US is buying more from other countries than it is selling to them. This imbalance has far-reaching effects on various aspects of the economy.

What Constitutes the Trade Deficit?

The trade deficit isn’t just about physical goods. It also includes services, such as tourism, financial services, and technology. Understanding the composition of the deficit is crucial for assessing its true impact.

Breaking down the trade deficit into its components reveals specific areas where the US relies heavily on imports. Identifying these areas can help policymakers and businesses make informed decisions about trade policies and investment strategies.

Here are the key components that are responsible for measuring the trade deficit:

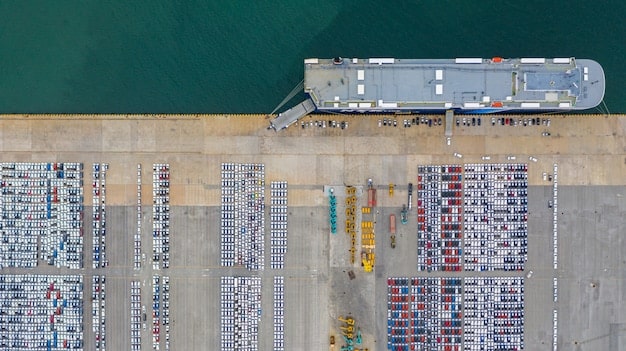

- Goods: Physical items like cars, electronics, and apparel.

- Services: Intangible products like tourism, consulting, and financial services.

- Primary Income: Income from investments abroad.

- Secondary Income: Transfers like foreign aid.

Analyzing the trade deficit involves examining these components to gain a comprehensive understanding of the factors driving the imbalance.

Historical Trends of the US Trade Deficit

The US trade deficit is not a new phenomenon; it has been a persistent feature of the American economy for several decades. Understanding its historical trends provides valuable context for evaluating the current situation and future projections.

Past Deficits and Economic Conditions

Throughout history, the trade deficit has fluctuated in response to various economic conditions, both domestic and global. Examining these fluctuations can help identify patterns and correlations.

For example, periods of strong economic growth in the US often coincide with larger trade deficits, as increased consumer demand leads to higher imports. Conversely, during economic downturns, the trade deficit may shrink as demand declines.

Here are some factors that affect trends in the market:

- Economic Growth: Higher growth often leads to more imports.

- Exchange Rates: A strong dollar can make imports cheaper.

- Global Events: Recessions or crises can disrupt trade flows.

- Trade Policies: Tariffs and trade agreements can alter trade balances.

Analyzing these historical trends provides a basis for forecasting future movements in the trade deficit and understanding the economic forces that drive them.

Causes of the Projected $950 Billion Deficit

Several factors contribute to the projected increase in the US trade deficit to $950 billion. These causes range from domestic economic policies to global economic conditions and geopolitical events.

Economic Policies and Consumer Demand

Government policies, such as fiscal stimulus measures, can boost consumer demand and lead to higher imports. Understanding these policy effects is crucial for predicting the impact on the trade deficit.

For instance, tax cuts can increase disposable income, leading to greater spending on imported goods. Similarly, infrastructure investments can require materials and equipment sourced from overseas, further widening the deficit.

Here are some factors responsible for the Deficit:

- Fiscal Stimulus: Government spending increases demand.

- Tax Cuts: Higher disposable income leads to more imports.

- Infrastructure Projects: Demand for imported materials.

Assessing the impact of economic policies on consumer demand and import behavior is essential for understanding the drivers of the trade deficit.

Impacts on the US Economy

The US trade deficit has several impacts on the American economy, affecting everything from job creation to economic growth and international competitiveness.

Job Creation and Manufacturing

One of the primary concerns surrounding the trade deficit is its potential impact on job creation, particularly in the manufacturing sector. Some argue that a large trade deficit indicates that domestic industries are losing out to foreign competition, leading to job losses.

However, others contend that the effects are more nuanced. While some manufacturing jobs may be lost due to import competition, other sectors, such as services, may benefit from increased trade. Additionally, lower import prices can boost consumer spending, indirectly supporting job creation in other areas of the economy.

Positive vs Negative Impacts of US Trade Deficit

The impacts of US Trade Deficit has both positive and negative points. Some are as follows:

- Job Losses: Some manufacturing jobs lost to foreign competition.

- Lower Import Prices: Benefit consumers and businesses.

- Economic Growth: Trade Deficit Reduces GDP Growth.

- Innovation and Competitiveness: Positive Effect on Economic growth.

Analyzing the trade deficit’s effects on different sectors of the economy is essential for gaining a comprehensive understanding of its overall impact.

Is a $950 Billion Deficit a Cause for Concern?

Whether a $950 billion trade deficit should be a cause for concern depends on various factors and economic perspectives. There is no one-size-fits-all answer, as the impacts can be complex and multifaceted.

Different Economic Perspectives

Economists hold varying views on the significance of trade deficits. Some argue that large deficits are unsustainable and pose a threat to long-term economic stability. They may point to the potential for increased foreign debt and the risk of currency devaluation as reasons for concern.

Others take a more benign view, arguing that trade deficits are a natural consequence of the US economy’s role as a global economic leader. They may emphasize the benefits of access to cheaper imports and the role of foreign investment in financing the deficit.

Factors to Consider

As a consumer, investor or a normal job holder you should consider these factors which are going to affect you in any way:

- Sustainability: Is the deficit sustainable in the long run?

- Financing: How is the deficit being financed?

- Productivity: US productivity can increase because of this.

Ultimately, whether the projected $950 billion deficit is a cause for concern depends on one’s economic perspective and the specific circumstances surrounding the deficit.

Strategies to Reduce the Trade Deficit

If policymakers and businesses deem it necessary to reduce the US trade deficit, several strategies can be implemented. These strategies range from domestic policy adjustments to international trade negotiations.

Boosting Exports and Domestic Production

One approach to reducing the trade deficit is to focus on boosting exports and promoting domestic production. This can involve a range of policy measures, such as tax incentives for exporters, investments in education and training to enhance workforce skills, and policies to encourage innovation and entrepreneurship.

Enhancing domestic production can reduce reliance on imports and create new jobs within the US. However, it may also require investments in infrastructure and regulatory reforms to make domestic industries more competitive.

Domestic and International Factors

The most important points that will help you to boost the exports are as follows:

- Tax Incentives: Encourage exports through tax breaks.

- Innovation: Foster entrepreneurship and new industries.

- Trade Agreements: Negotiate fair trade deals.

Implementing these strategies requires a coordinated effort by policymakers, businesses, and workers to promote economic growth and reduce the trade deficit.

| Key Point | Brief Description |

|---|---|

| 📈 Growing Deficit | The US trade deficit is projected to hit $950 billion. |

| 💼 Job Impact | Debates focus on job creation, especially in manufacturing. |

| 🌎 Global Factors | Influenced by economic policies and global events. |

| 🔄 Strategies | Boosting exports and domestic production are key. |

FAQ

▼

A trade deficit occurs when a country imports more goods and services than it exports over a specific period. It signifies that a nation is purchasing more from other countries than it is selling to them.

▼

The US trade deficit is projecting to increase mostly due to factors such as fiscal stimulus, strong customer demands and other infrastructure projects. These demands lead to importing more products, thus increasing the deficit.

▼

The impact on job creation is complex. Because of this deficit some sectors in the manufacturing field are seeing the losses, others are experiencing the effects of consumers benefiting in lower import prices.

▼

Strategies include domestic methods with improvements to production quality, and international negotiations. This is an effort to level the field. Another area for improvement is promoting the US exports.

▼

Not necessarily. While some view it negatively due to job losses and increased debt, others see it as a natural outcome of economic leadership, providing consumers with cheaper goods and attracting foreign investment.

Conclusion

In conclusion, the projected increase in the US trade deficit, Is the Projected Increase to $950 Billion a Cause for Concern? to $950 billion raises valid concerns and requires a thorough understanding of its causes. Whether it’s a cause for alarm depends on various factors, including economic perspectives, sustainability, and financing. By implementing effective strategies to boost exports, promote domestic production, and address unfair trade practices, the US can mitigate the potential negative impacts and foster a more balanced and prosperous economy.