CBAM Impact: How EU Carbon Border Tax Affects US Exports in 2025

The EU’s Carbon Border Adjustment Mechanism (CBAM) is poised to significantly impact US exports to Europe by 2025, imposing carbon levies on goods produced in the US without equivalent carbon pricing, potentially altering trade flows and competitiveness.

The implementation of the European Union’s Carbon Border Adjustment Mechanism (CBAM) in 2025 is set to reshape the landscape of international trade, particularly impacting nations like the United States that export goods to Europe. The How Will the EU’s Carbon Border Adjustment Mechanism (CBAM) Affect US Exports to Europe in 2025? question is complex, involving economic, political, and environmental considerations that will require careful navigation by US exporters.

Understanding the EU’s Carbon Border Adjustment Mechanism (CBAM)

The European Union’s commitment to achieving carbon neutrality by 2050 has led to the development of the Carbon Border Adjustment Mechanism (CBAM). It’s a crucial part of the EU’s strategy to reduce carbon emissions and prevent “carbon leakage.”

What is Carbon Leakage?

Carbon leakage occurs when companies move their production to countries with less stringent environmental regulations to avoid carbon emission costs. This relocation diminishes the effectiveness of the EU’s climate policies. CBAM is designed to prevent this by ensuring that imported goods are subject to a carbon price equivalent to what they would pay if produced within the EU.

How CBAM Works

CBAM works by imposing a carbon levy on specific goods imported into the EU from countries with less rigorous carbon pricing policies. This levy is based on the carbon content of the goods, aiming to level the playing field between domestic EU producers and foreign exporters. The mechanism effectively puts a price on the carbon emissions associated with the production of those goods.

Ultimately, the EU Carbon Border Adjustment Mechanism ensures a fair price is paid on goods for carbon emissions produced. In doing so, the EU hopes to push other countries towards greener practices which in turn, may avoid significant export costs.

Which US Exports Are Most Vulnerable to CBAM?

Several US export sectors are particularly exposed to the impact of CBAM, including those that are energy-intensive and rely on carbon-heavy production processes. Understanding which sectors are most vulnerable is essential for US businesses to prepare for the policy’s implications.

- Steel and Aluminum: These sectors are highly energy-intensive, and production often relies on carbon-intensive processes.

- Cement: Cement production is a major source of carbon emissions due to the calcination process, which releases CO2.

- Fertilizers: The production of fertilizers, particularly nitrogen-based fertilizers, is energy-intensive and involves significant carbon emissions.

- Electricity: While not directly a physical export, embedded electricity in exported goods comes under scrutiny, especially if produced from carbon-intensive sources.

These sectors will face increased costs when exporting to the EU, impacting their competitiveness. It will ultimately force businesses in particular sectors to innovate to reduce energy intensity to offset the economic strain.

Therefore, sectors that rely heavily on fossil fuels for energy and have not invested in low-carbon technologies are most at risk from CBAM.

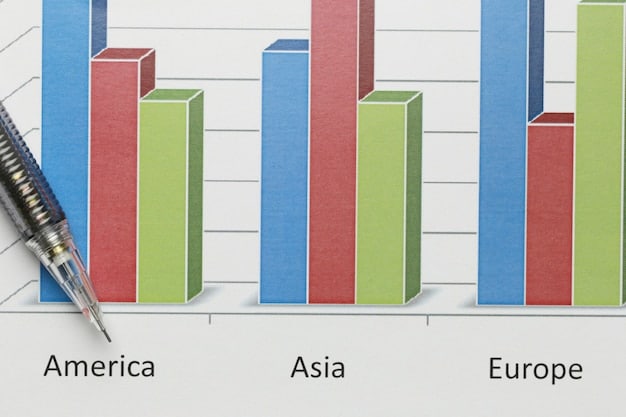

The Economic Impact on US Exporters

The economic consequences of CBAM on US exporters are multifaceted, potentially affecting trade volumes, market access, and the overall competitiveness of US products in the European market. Understanding these impacts is important for developing strategies to mitigate negative effects.

Increased Costs and Reduced Competitiveness

The immediate impact of CBAM will be increased costs for US exporters subject to the carbon levy. This will make US products more expensive in the EU market, potentially reducing their competitiveness compared to goods from countries with lower carbon emissions or those that have carbon pricing policies aligned with the EU.

Potential for Trade Diversion

US exporters might seek alternative markets outside the EU to avoid CBAM-related costs. This trade diversion could shift export flows to regions with less stringent environmental regulations or lower trade barriers. However, this strategy may not be viable for all sectors or companies, and it could have long-term implications for the composition of US exports.

Impact on Small and Medium-Sized Enterprises (SMEs)

SMEs may face a more substantial challenge in adapting to CBAM than larger corporations. They typically have fewer resources to invest in low-carbon technologies or navigate the complexities of CBAM compliance. This could disproportionately affect their ability to export to the EU.

The magnitude of the economic impact will depend on several factors, including the carbon intensity of US production processes, the level of the carbon levy imposed by CBAM, and the ability of US exporters to adopt low-carbon technologies and practices. The impacts will likely be felt at both micro and macro economic levels for industries that rely heavily on exports to the EU.

Navigating CBAM: Strategies for US Businesses

To mitigate the adverse effects of CBAM, US businesses need to adopt proactive strategies focused on reducing carbon emissions, improving energy efficiency, and adapting their production processes. Here are several approaches that US exporters can consider:

Investing in Low-Carbon Technologies

One of the most effective ways to reduce CBAM-related costs is to invest in technologies and practices that lower carbon emissions. This could include transitioning to renewable energy sources, implementing energy-efficient equipment, and adopting circular economy principles.

Improving Energy Efficiency

Enhancing energy efficiency not only reduces carbon emissions but also lowers production costs. US businesses can implement energy management systems, conduct energy audits, and adopt best practices to minimize energy consumption.

Adopting Carbon Pricing Mechanisms

The US government and individual states may consider implementing carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems, to incentivize emissions reductions and align with the EU’s carbon pricing framework. This could potentially reduce the CBAM levies imposed on US exports.

Seeking Government Support and Incentives

US exporters should explore government programs and incentives that support investments in low-carbon technologies and sustainable practices. These programs can provide financial assistance, technical expertise, and guidance on CBAM compliance.

Ultimately, US businesses will need to consider the cost of carbon emissions produced alongside other economic costs, which will greatly influence production processes over time. Businesses will be required to adapt quickly or face competitive disadvantage.

The Geopolitical Implications of CBAM

Beyond the economic and business implications, CBAM carries significant geopolitical implications for the US and its relationship with the EU. Understanding these dimensions is crucial for crafting effective policy responses.

Potential for Trade Disputes

CBAM could become a source of trade friction between the US and the EU, particularly if the US perceives the mechanism as discriminatory or protectionist. This could lead to trade disputes and retaliatory measures, potentially escalating tensions between the two economic powers.

Impact on International Climate Negotiations

CBAM could influence international climate negotiations by encouraging other countries to adopt carbon pricing mechanisms. However, it could also create resentment and mistrust, particularly among developing nations that view CBAM as an unfair barrier to trade.

The Role of the US in Global Climate Action

The US’s response to CBAM will shape its role in global climate action. If the US embraces carbon pricing and invests in emissions reductions, it could strengthen its position as a leader in addressing climate change. Conversely, resistance to CBAM could undermine its credibility and influence in international climate forums.

Ultimately, CBAM has the potential to alter international relationships, particularly for the world’s richest global economies. Careful approaches to negotiation and trade will be essential.

The Future of US-EU Trade Under CBAM

Looking ahead, the future of US-EU trade under CBAM will depend on how the US and its businesses adapt to the new carbon pricing landscape. Several possible scenarios could unfold:

- Increased Cooperation: The US and the EU could work together to harmonize carbon pricing policies and promote global emissions reductions. This would involve establishing common standards, sharing best practices, and coordinating efforts to support developing countries in their climate transitions.

- Trade Conflicts: If the US and the EU fail to find common ground, trade disputes could escalate, leading to increased tariffs and barriers to trade. This would harm both economies and undermine global climate efforts.

- Adaptation and Innovation: US businesses could successfully adapt to CBAM by investing in low-carbon technologies, improving energy efficiency, and developing innovative products and services. This would allow them to remain competitive in the EU market while contributing to global climate goals.

For exporters and policy makers alike, the time to act and innovate is now. All players involved must understand the new expectations and adapt.

In conclusion, the How Will the EU’s Carbon Border Adjustment Mechanism (CBAM) Affect US Exports to Europe in 2025? question is far-reaching, but careful planning and consideration can help make it through this paradigm shift.

| Key Point | Brief Description |

|---|---|

| 🇪🇺 CBAM Objective | Prevents carbon leakage by pricing imports based on carbon content. |

| 🏭 Affected Sectors | Steel, aluminum, cement, and fertilizers are most vulnerable exports. |

| 📈 Economic Impact | Increased costs, reduced competitiveness, and potential trade diversion. |

| 🌱 Mitigation Strategies | Invest in low-carbon tech, improve efficiency, and seek government support. |

Frequently Asked Questions

▼

The main goal is to prevent carbon leakage, ensuring that imported goods bear a carbon price equivalent to those produced within the EU, and thereby incentivizing greener production globally.

▼

Countries with carbon-intensive industries and less stringent environmental regulations, such as those heavily reliant on coal-based energy, face the greatest impact from CBAM.

▼

US exporters can prepare by investing in energy-efficient technologies and reducing their carbon footprint. Also, seek government incentives and support for sustainable practices.

▼

Likely outcomes include increased pressure for global carbon pricing, potential trade disputes between nations, and a reshaping of international alliances based on climate policies.

▼

Initially, CBAM will apply to specific sectors, including steel, aluminum, cement, fertilizers, and electricity. Over time, its scope is expected to expand to include additional goods.

Conclusion

In conclusion, the EU’s Carbon Border Adjustment Mechanism (CBAM) presents both challenges and opportunities for US exporters. By proactively adopting low-carbon technologies, improving energy efficiency, and engaging in constructive dialogue with the EU, US businesses can mitigate the adverse effects of CBAM and contribute to a more sustainable global economy.