Decoding Russia Sanctions: A US Business Survival Guide for 2025

Decoding the Latest Sanctions Against Russia: A US Business Survival Guide offers a comprehensive analysis for US businesses navigating the complexities of international sanctions, providing strategies for compliance and risk mitigation in a volatile geopolitical landscape.

Navigating the intricate web of international sanctions can be daunting for any US business. This guide, Decoding the Latest Sanctions Against Russia: A US Business Survival Guide, offers essential insights and strategies to ensure compliance and mitigate risks in an ever-changing geopolitical landscape.

Understanding the Current Sanctions Landscape

The sanctions against Russia are a multifaceted and evolving set of restrictions imposed by the United States and its allies. These measures target various sectors of the Russian economy, individuals, and entities deemed to be supporting or benefiting from actions that undermine international norms.

For US businesses, understanding the scope and implications of these sanctions is paramount to avoid inadvertent violations and ensure continued operations.

Key Sanctioning Entities

Several US government agencies are involved in implementing and enforcing sanctions against Russia. Understanding their roles is crucial for compliance.

- Office of Foreign Assets Control (OFAC): OFAC administers and enforces economic and trade sanctions based on US foreign policy and national security goals.

- Bureau of Industry and Security (BIS): BIS regulates the export and re-export of sensitive goods and technologies.

- Department of Justice (DOJ): DOJ investigates and prosecutes violations of sanctions regulations.

Businesses should regularly consult the websites of these agencies for updates and guidance on sanctions compliance.

Staying informed about the specific regulations and restrictions imposed by each agency is critical for maintaining compliance and avoiding penalties.

The landscape of sanctions is constantly shifting, necessitating continuous monitoring and adaptation.

In conclusion, understanding the current sanctions landscape requires constant vigilance and a proactive approach to compliance. Businesses must familiarize themselves with the relevant regulations, monitor updates from sanctioning entities, and implement robust compliance programs to mitigate risks.

Assessing Your Business’s Exposure to Sanctions Risks

The first step in navigating sanctions compliance is to assess the extent to which your business might be exposed to Russia-related risks. This involves evaluating your operations, supply chains, and financial transactions to identify potential vulnerabilities.

A thorough assessment will help you understand the specific areas where you need to focus your compliance efforts.

Conducting a Comprehensive Risk Assessment

A comprehensive risk assessment should cover all aspects of your business that could potentially be affected by sanctions.

- Customer Screening: Verify the identities of your customers and counterparties to ensure they are not on any sanctions lists, using advanced tools and databases.

- Supply Chain Due Diligence: Map your supply chain to identify any connections to Russia, including suppliers, manufacturers, and distributors.

- Transaction Monitoring: Implement systems to monitor your financial transactions for any red flags that could indicate sanctions violations, such as unusual patterns or transactions with sanctioned entities.

By implementing these measures, businesses can better mitigate the risk of sanctions violations and maintain smooth operations.

A well-documented risk assessment process demonstrates a commitment to compliance and can be valuable in the event of a government inquiry.

In short, a comprehensive risk assessment is essential for understanding and mitigating the potential impact of Russian sanctions on US businesses. By carefully evaluating their operations, supply chains, and financial transactions, businesses can identify vulnerabilities and take proactive steps to ensure compliance.

Building a Robust Sanctions Compliance Program

Once you have assessed your business’s exposure to sanctions risks, the next step is to develop and implement a robust compliance program that can effectively mitigate those risks. This program should be tailored to your specific business and industry.

A well-designed compliance program will help you prevent sanctions violations and demonstrate your commitment to complying with US law.

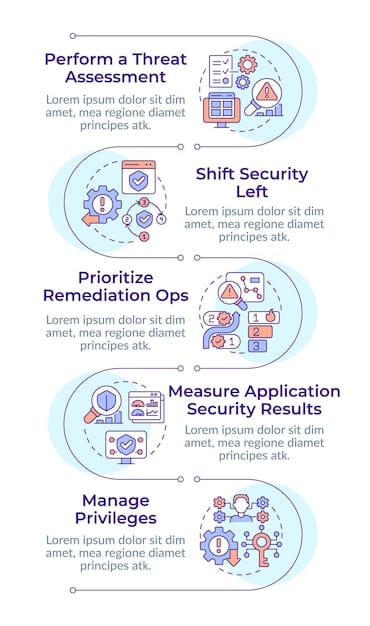

Key Components of a Compliance Program

A robust sanctions compliance program should include several key components.

- Written Policies and Procedures: Develop clear and comprehensive policies and procedures that outline how your business will comply with sanctions regulations.

- Employee Training: Provide regular training to your employees on sanctions regulations and your company’s compliance policies.

- Monitoring and Auditing: Implement systems to monitor your transactions and activities for compliance and conduct regular audits to identify any weaknesses in your program.

With consistent monitoring and auditing, businesses can more easily adapt to new circumstances while maintaining compliance.

Remember that a compliance program is not a one-time effort but an ongoing process that requires continuous improvement and adaptation.

In conclusion, building a robust sanctions compliance program is crucial for protecting US businesses from the risks associated with violating sanctions against Russia. By developing clear policies, providing regular training, and implementing effective monitoring and auditing systems, businesses can ensure compliance and mitigate potential penalties.

Navigating Specific Sanctions Regulations

The sanctions against Russia cover a wide range of activities and sectors. To effectively comply, it’s essential to understand the specific regulations that apply to your business. This section will explore some of the key areas covered by the sanctions.

Each regulation has its own nuances, so it’s important to consult the official guidance from OFAC and other relevant agencies.

Understanding Sectoral Sanctions

Sectoral sanctions target specific sectors of the Russian economy, such as energy, finance, and defense. US businesses are generally prohibited from engaging in certain types of transactions with entities operating in these sectors.

It’s crucial to identify whether you do business with companies in these sanctioned sectors.

- Energy Sector: Restrictions on providing financing or technology for certain energy projects in Russia.

- Financial Sector: Prohibitions on certain types of transactions with designated Russian financial institutions.

- Defense Sector: Restrictions on exporting or providing goods, services, or technology to the Russian defense sector.

Compliance requires careful screening of counterparties and transactions and staying up-to-date on any changes to the sanctions regulations.

Navigating these restrictions requires meticulous attention to detail and a thorough understanding of the specific regulations.

In sum, navigating specific sanctions requires a detailed understanding of sectoral sanctions, export controls, and dealings with sanctioned individuals and entities. US businesses must carefully screen their counterparties and transactions, stay up-to-date on the latest regulations, and seek expert advice when needed to ensure compliance and avoid potential penalties.

Leveraging Technology for Sanctions Compliance

Technology can play a crucial role in enhancing your sanctions compliance efforts. A variety of software solutions and tools are available to help you automate customer screening, transaction monitoring, and other compliance tasks.

By leveraging technology, you can improve the efficiency and accuracy of your compliance program.

Available Tech Solutions

From automated screening tools to AI-driven risk assessment, technology can streamline compliance efforts.

- Automated Screening Tools: These systems automatically screen your customers and counterparties against sanctions lists and other watchlists.

- Transaction Monitoring Systems: Monitor your financial transactions for suspicious activity and potential sanctions violations.

- Data Analytics: Use data analytics tools to identify trends and patterns that could indicate sanctions risks.

Selecting the right technology solutions will depend on your business’s specific needs and risk profile, so it’s important to evaluate different options carefully.

The investment in technology can often yield significant cost savings by automating compliance tasks and reducing the risk of human error.

All things considered, leveraging technology will make it easier for your business to keep pace with changes in sanctions regulations.

To summarize, leveraging technology is essential for enhancing sanctions compliance efforts and mitigating potential penalties. By implementing automated screening tools, transaction monitoring systems, and data analytics solutions, US businesses can improve the efficiency and accuracy of their compliance programs and stay ahead of evolving regulations.

Seeking Expert Guidance and Resources

Navigating the complexities of sanctions compliance can be challenging. It’s often advisable to seek expert guidance from attorneys, consultants, and other professionals who specialize in sanctions law and compliance.

Working with experienced professionals can help you develop and implement a tailored compliance program that meets your specific needs.

Professional Support

Expert knowledge is essential for ensuring comprehensive compliance.

Accessing professional support ensures businesses are well-prepared to deal with any sanctions-related challenges.

- Legal Counsel: Attorneys specializing in sanctions law can provide guidance on interpreting regulations and developing compliance strategies.

- Compliance Consultants: Consultants can help you assess your risks, develop a compliance program, and train your employees.

- Industry Associations: Associations provide resources, training, and networking opportunities for compliance professionals.

| Key Point | Brief Description |

|---|---|

| ⚠️ Understanding Sanctions | Knowing current regulations is key to avoid violations. |

| 🔍 Risk Assessment | Evaluate your business for potential vulnerabilities. |

| 🛡️ Compliance Program | Implement policies, training, and monitoring to ensure compliance. |

| 🤖 Tech Solutions | Use technology for automated screening and monitoring. |

Frequently Asked Questions

▼

The sanctions aim to deter Russia from actions that destabilize international norms and undermine global security by imposing economic costs and limiting access to key resources and technologies.

▼

Sanctions regulations can be updated frequently, sometimes in response to rapidly changing geopolitical events. Businesses should monitor OFAC and BIS websites regularly for updates and changes.

▼

Penalties for violating sanctions can include significant fines, imprisonment, and reputational damage. The severity of the penalty depends on the nature and extent of the violation.

▼

Technology solutions automate customer screening, monitor transactions for red flags, and analyze data to identify potential sanctions risks, enhancing compliance efficiency and accuracy.

▼

You can seek expert advice from attorneys specializing in sanctions law, compliance consultants, and industry associations, who can provide tailored guidance and support for your compliance efforts.

Conclusion

Navigating the complex landscape of sanctions against Russia requires diligence, expertise, and a commitment to compliance. By understanding the regulations, assessing your risks, building a robust compliance program, leveraging technology, and seeking expert guidance, US businesses can effectively mitigate the risks and ensure continued operations in a challenging global environment.